Managing M&A Integration Post COVID-19

Learn methods to preserve and build corporate value during COVID-19 and beyond.

-------------------------------------------

12 PM Eastern, 9 AM Pacific

June 29th - July 1st (1 hour per day)

3 hours of online / live class + material $195 USD

Scroll down to learn more about this course

Reserve NowExperience-Driven Content

Valuable integration practices derived from over 400 acquisitions delivered by experts

Live Classes + On Demand

Live, interactive classes available for viewing for 30 days after class completion

Timely

Content tailored to address challenges of COVID-19 and a new normal

What Will You Learn:

Strategic Alignment

Help ensure integration plans deliver on transaction objectives and critical success factors

Achieving Synergies

Line-of-sight & closed-loop approaches to defining and tracking transaction synergies

Integration Program Management

Proven planning & execution regimens grounded in project management practices that empower teams and speed execution

Day 1 Readiness

360 degree communication approaches that engage employees, customers and other key stakeholder groups

Cultural Integration & Change Management

Practical approaches to addressing cultural integration and change management for integration scenarios

Virtual & Remote Best Practices

How to manage complex projects with extended teams in the post Covid working environment

Feedback on Our Training

Sr. Director M&A, Symantec, Inc.

Position

SVP, Chief Business Processes Officer, Teva Pharmaceuticals

Position

Independent Management Consultant, United States

Position

More About this Training + Reserve Your Seat

Description

M&A strategies are evolving during the COVID-19 pandemic, and so must the methods to preserve & build corporate value after a merger or acquisition. This live, online course is established for corporate development leaders, private equity operating partners, and executives leading post-merger integration activity. In this course we will distill fundamental changes required to address M&A integration needs during and after the COVID-19 pandemic, and walk through core planning & execution principles to effectively manage any integration project.

Format

This course is delivered in three one-hour sessions utilizing Zoom with active participation from attendees. The course will include a downloadable PDF of session materials. If an attendee cannot make one or more sessions, each session will be recorded and will be available for one month after course completion.

Areas of Emphasis

1. What worked before does not necessarily guarantee success post COVID-19

2. Managing integration projects in the post COVID-19 environment

3. Process, Tools, and Governance in distributed settings

4. Rebooting in-flight integration projects that have been paused due to COVID-19

Agenda for the Three One-Hour Sessions

Session 1

Best Practices for Integrating People, Process, and Technology in the "New Normal"

* Establishing Integration Scope

* Defining and Standing Up Integration Governance

* Implications for Communications and Culture

Session 2

Integration Preparation Essentials in Lean and Distributed Environments

* Integration Diligence

* Mobilizing an Integration Management Office

* Synergy Program Management

Session 3

Establishing the Integration Team and Building Integration Playbooks

* Resourcing for the Integration Team in Matrixed and Remote Settings

* Developing Integration Playbooks for Serial Acqusitions

* Turning Training into Action - Implementing What You Have Learned

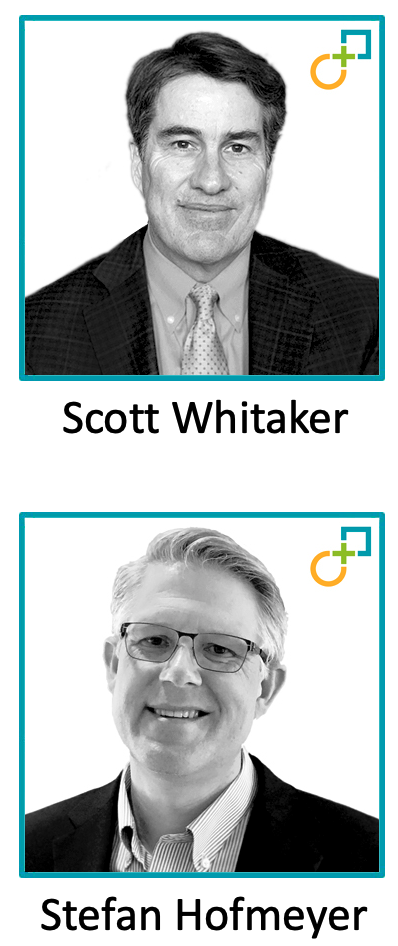

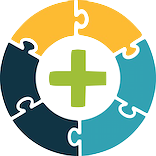

About The Instructors

Scott Whitaker has extensive experience in all aspects of merger and post-acquisition integration, and has advised clients across dozens of industry sectors covering small, mid and large cap transactions totaling more than $100 billion in value. Scott has worked internationally in Canada, China, Europe and Africa on a variety of assignments, and specializes in mobilizing Integration Management Offices (IMO’s) and helping companies develop integration playbooks. Learn More

Stefan Hofmeyer leads the development and execution of repeatable M&A integration and carve-out solutions for private equity firms and acquisitive corporations. He speaks internationally in the field of acquisition integration management and has contributed to the books: Mergers & Acquisitions – A Practitioner’s Guide to Successful Deals, 2019, World Scientific Publishers, and Cross-border Mergers and Acquisitions, 2016, Wiley & Sons Publishers. Stefan is a cross-cultural expert, working and traveling to over 40 countries. Learn More

----------------

Visit www.gpmip.com for more information

Click Here for Book Contributions By Global PMI Partners

Click Here for Global PMI Partners Case Studies